For many people, the word “frugal” fits into the four-letter word category. Being frugal in our culture is thought to be equivalent to being cheap or living a life of self-denial.

That is definitely not the case! Frugal living is about living comfortably within your means, and controlling your finances instead of your finances controlling you.

Frugal Living Ideas

If you have decided to live a more frugal lifestyle but aren’t sure where to start, here are five frugal living ideas to help you transition to this full life on less:

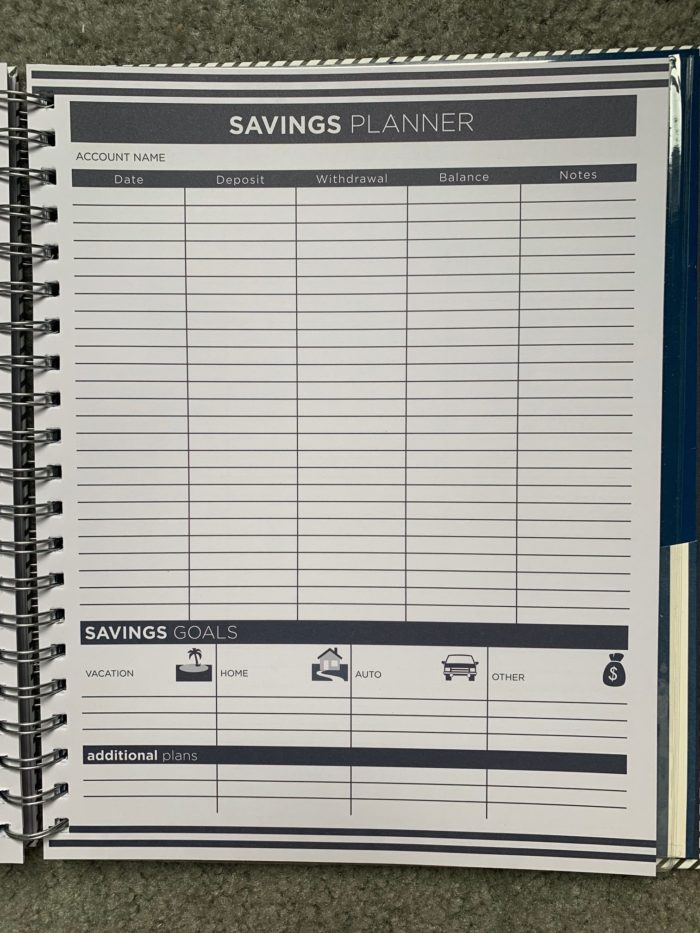

Make a Budget

You’ve definitely heard this advice over and over again, but it’s still a necessary part of controlling your finances. If you don’t know where your money is going, there’s no way to decide which areas need cutbacks.

It’s simple to make a basic budget. Use your online bank statements to track purchases for the past month. If you primarily use cash, save your receipts for the next two weeks.

Then, create a simple breakdown of where your money is going. You might be surprised at how much money goes to non-essential items.

Plug Up Any Money Leaks

Money has a tendency to ‘leak’ out of your bank account. You find the actual amount of money you’re spending on simple items adding up to more than you’d have expected. Plugging up all of these leaks will involve determining which extra items you’re willing to put up with, and which need to be cut down or completely deleted from the budget.

Cut Back On Essential Spending

Before spending extra money, take a moment to ask yourself if you really need the item you’re about to purchase. Simply asking yourself something like “is this backpack worth the money?” can easily cut your random expenses in half.

If you’re buying an expensive item like a car, do plenty of research to maximize the benefit you’ll receive after you purchase it. Doing a little bit of research can save you a lot of money in the long run.

Plan for the future

Instead of waiting for major expenses like car repairs to sneak up on you, set money aside in an emergency account. This is something that many people call a “sinking fund”; you create accounts, or put money in envelopes, to prepare for expenses you know are coming up.

Also, plan ahead for major purchases. Saving up a substantial down payment on a house, for instance, will significantly reduce the amount you spend over time.

{Related: Money-Saving Things Homeowners Do Once A Year}

Set up a Frugal Living Reward System

This is my favorite part of frugal living! There are so many opportunities to treat yourself, and always have money to do so.

Don’t destroy your early attempts at being frugal by depriving yourself too much. If life without Starbucks seems like a fate worse than death, budget a certain number of latte runs into your week.

Our family loves to splurge on fun experiences, or dinner out once a month. All of it is budgeted ahead of time, which takes away the stress of spending. Allowing for extras will encourage you to stick with your long term financial plan.